Condo Insurance in and around Moss Point

Townhome owners of Moss Point, State Farm has you covered.

Condo insurance that helps you check all the boxes

There’s No Place Like Home

When looking for the right condo, it's understandable to be focused on details like home layout and neighborhood, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Townhome owners of Moss Point, State Farm has you covered.

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

Things do happen. Whether damage from weight of sleet, theft, or other causes, State Farm has excellent options to help you protect your townhome and personal property inside against unanticipated circumstances. Agent Brenda Thompson would love to help you develop a policy that is personalized to your needs.

Finding the right protection for your condo is made easy with State Farm. There is no better time than today to call or email agent Brenda Thompson and discover more about your terrific options.

Have More Questions About Condo Unitowners Insurance?

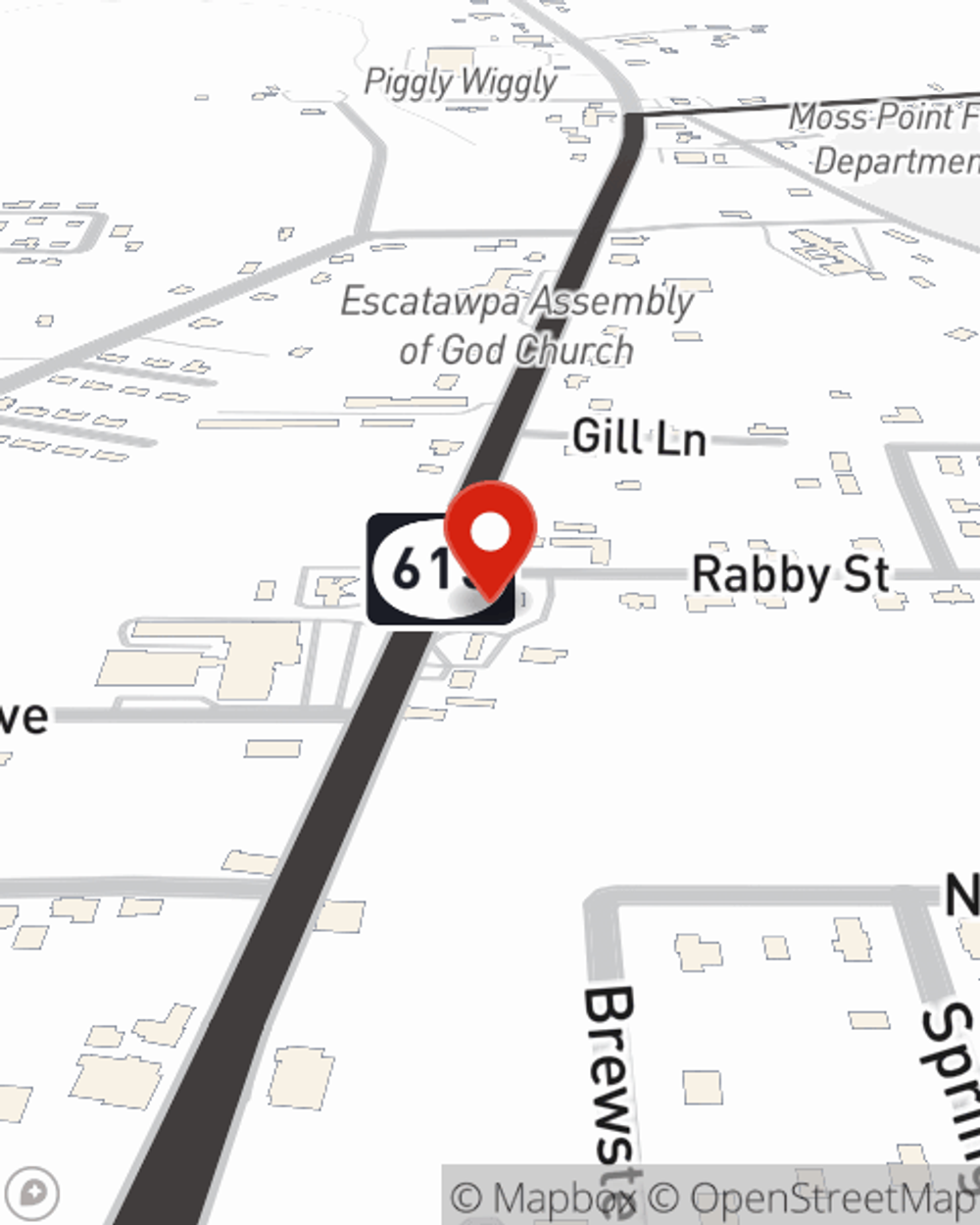

Call Brenda at (228) 474-5433 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Brenda Thompson

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.